💸 Jyoti Structures Share Price Target 2025: ₹28 Possible? Penny Stock Se Turnaround!

By Kapeesh Chaubey

Jyoti Structures ka stock abhi ₹18–19 ke aaspaas trade kar raha hai (as of July 2025). Yeh ek classic penny stock turnaround story ban sakti hai, jahan technicals bhi support kar rahe hain aur company ne naye projects bhi secure kiye hain. Toh kya ₹28 ka target possible hai?

🏗️ Recent Project Wins (Source: jyotistructures.in/projects)

- 765 kV D/C Khavda–Bhuj PS Transmission Line – Large‑scale EPC project for Adani & PowerGrid

- 400 kV Chandrapur–Padghe Line (Maharashtra) – Completed in record 11 months

- 220 kV Switchyard & Line for Wardha Steel – End‑to‑end turnkey project

- International Expansion – Pre‑qualified for Kenya power line project

- 🔗 View all recent projects: Click Here

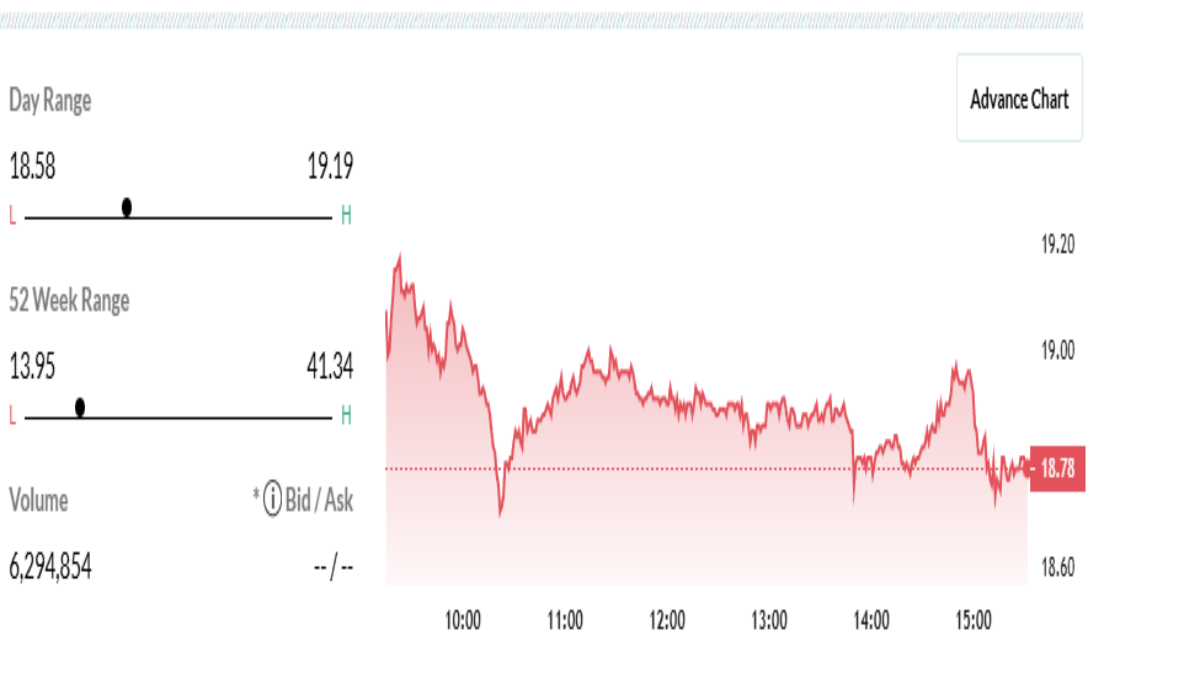

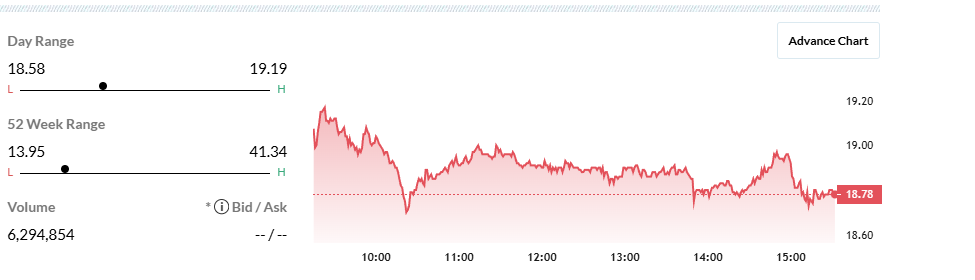

📊 Technical Analysis (as per Moneycontrol)

- Current Price: ₹18.8

- VWAP Trend: Above 5‑ & 10‑day (bullish); below 20/50‑day (neutral)

- Pivot Point: ₹19.11

- Resistance Levels: ₹19.35 – ₹19.88

- Momentum: RSI – neutral/bullish, MACD – flat but turning positive

Note: Close above ₹19.35 could confirm bullish breakout.

🚀 ₹28 Ka Target Roadmap

- Short‑Term Trigger: Breakout above ₹19.35

- Mid‑Term Move: ₹21–22 with volume support

- Long‑Term Target: ₹26–₹28 by end‑2025

Infra push jaise Green Energy Corridors & large T&D orders is target ko support karte hain.

⚠️ Risks

- Breakout failure can pull it down to ₹17–18

- Execution delays, market volatility, cost inflation

- Penny stock volatility – patience needed

💡 Entry Strategy

- Entry Zone: ₹17.8 – ₹18.8

- Stop‑Loss: ₹17

- First Target: ₹21

- Long‑Term Target: ₹28 (2025)

🧠 Final Verdict

Jyoti Structures ek penny stock hai jo sahi execution aur infra demand ke saath ₹28 tak jaa sakta hai. Technical indicators aur strong order book is turnaround ko support karte hain. Long‑term investors ke liye yeh ek potential rewarding bet ho sakta hai — high risk, high reward.

📢 Stay Updated on More Stocks Like This

The Moneycontrol page for Jyoti Structures Ltd. (JS03) shows detailed stock data including:

- Live Price, Volume & Intraday Charts

- 52-week high/low (₹41.34 / ₹13.95)

- Technical indicators like RSI, MACD, moving averages

- Fundamentals like P/E, book value, and past performance

- Company announcements & project updates

📌 You can view the full technical and fundamental breakdown directly here:

👉 Moneycontrol: Jyoti Structures Stock Details

⚠️ Disclaimer

Stock market investments are subject to market risks. The views and analysis provided here are for informational and educational purposes only and do not constitute investment advice. QuickDayNews and the author are not SEBI-registered financial advisors. Readers should do their own research or consult with a certified expert before making any investment decisions.

📈 For official data, visit:

👉 Moneycontrol: Jyoti Structures Stock Info