By Kapeesh Chaubey | Updated: July 18, 2025 | Source: QuickDayNews.com

Reliance Industries ne FY26 ke Q1 (April–June 2025) mein solid performance diya. Company ka consolidated net profit ₹26,994 crore tak pahucha — jo ki approx 78% YoY ka jump hai, majorly ek-time gain ke chalte. Bina is gain ke bhi recurring profit 25% se zyada bada hai.

📊 Q1 Highlights (YoY Basis):

- Net Profit (PAT): ₹15,138 Cr → ₹26,994 Cr (78% jump)

- Total Revenue: ₹2.58 Lakh Cr → ₹2.73 Lakh Cr (6% growth)

- EBITDA: ₹42,748 Cr → ₹58,024 Cr (36% growth)

- Retail Revenue: ₹75,000 Cr → ₹84,171 Cr (11% growth)

- Jio Profit: ₹5,670 Cr → ₹7,110 Cr (25% growth)

📌 Note: Asian Paints stake bechne se ~₹8,924 Cr ka ek-time gain hua tha.

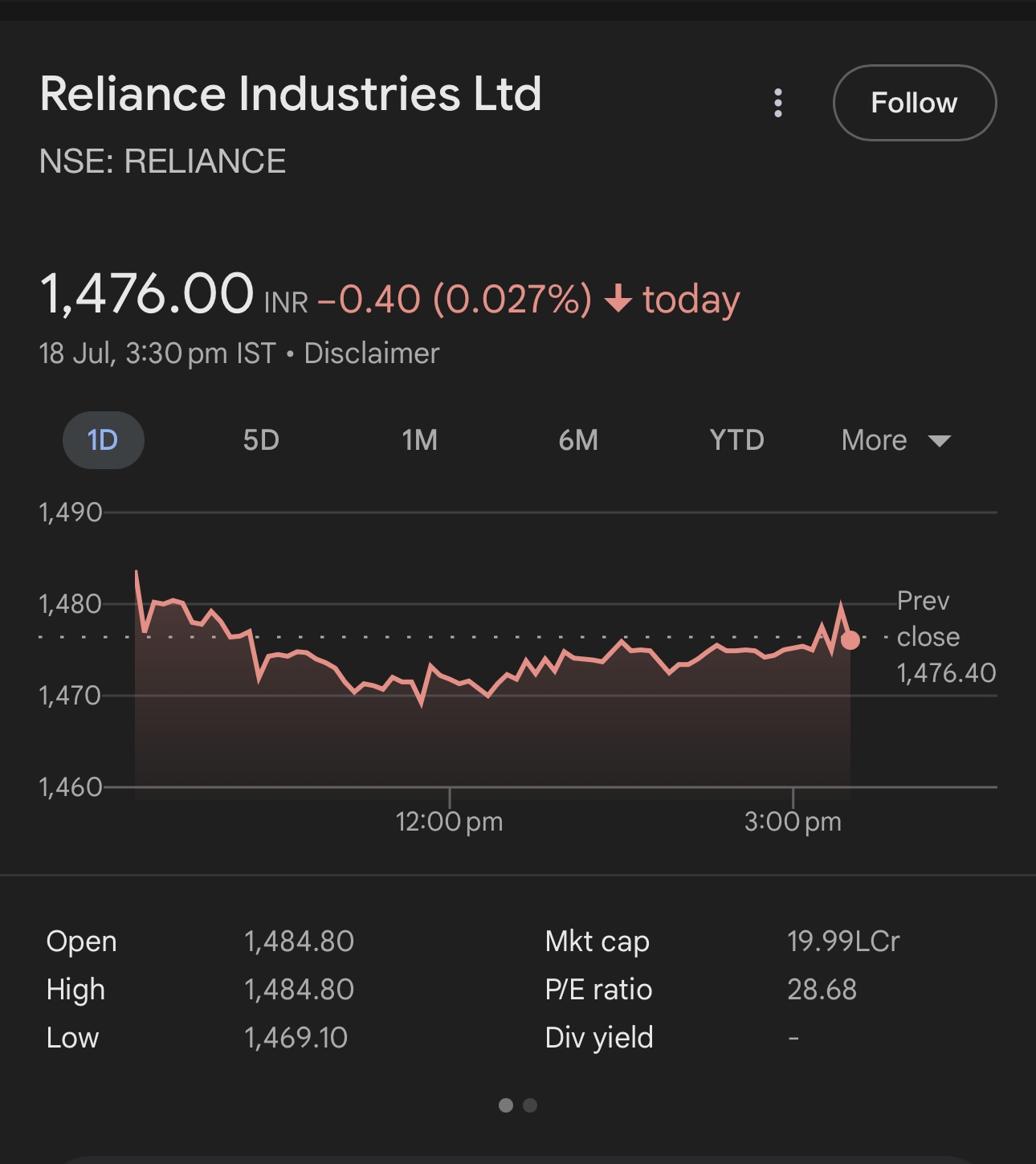

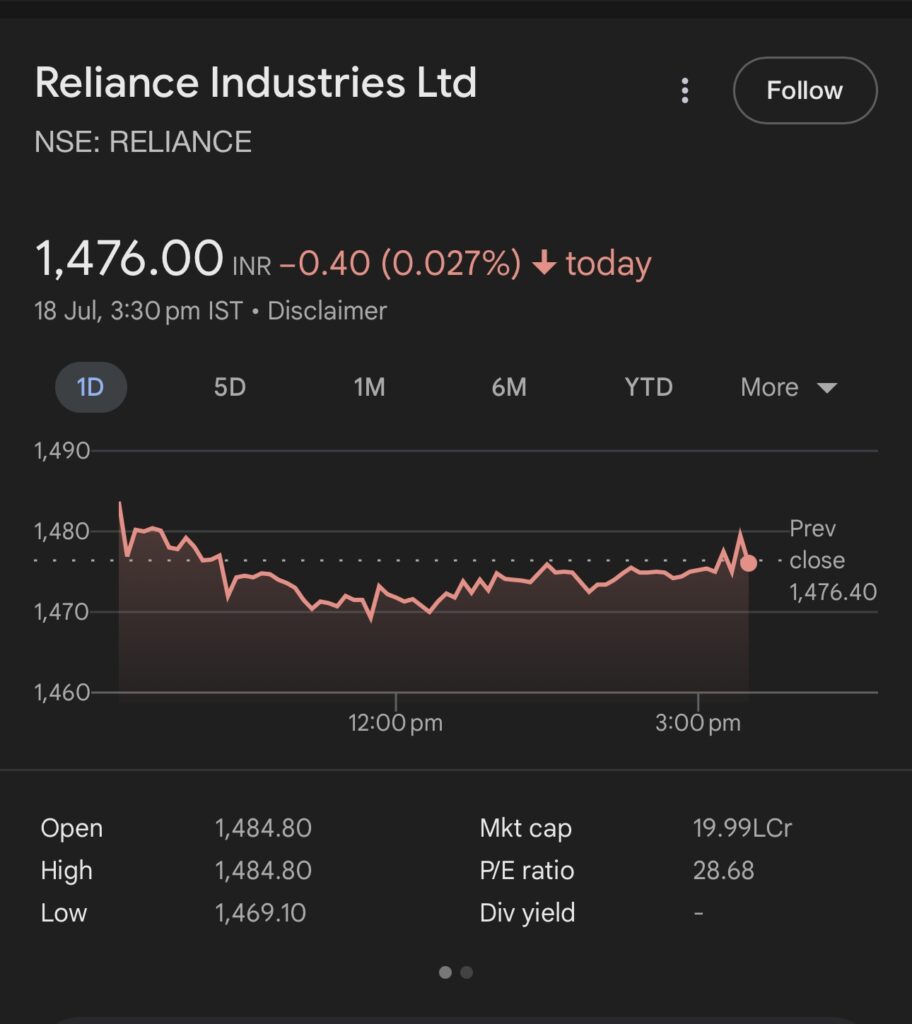

📈 Current Stock Price & Movement (July 2025):

- CMP: ₹1,476

- Range: ₹1,470 – ₹1,500 (last 30 days)

Stock abhi ₹1,500 ke resistance pe tikka hai. Ek breakout se upward move possible hai.

🎯 Kya ₹2,000 Tak Jaayega Reliance Share?

Analysts Ke Realistic Targets (Next 6–12 Months):

| Broker/Analyst | Target Price | Outlook |

|---|---|---|

| ICICI Securities | ₹1,850 | Positive |

| Axis Securities | ₹1,920 | Moderate Buy |

| Jefferies (Revised) | ₹2,000 | Aggressive Buy |

➡️ Upside from Current Price (₹1,476 to ₹2,000): approx 35% growth potential in 12–15 months.

🔍 Growth Drivers:

- Jio: 200+ million 5G subscribers, profit +25% YoY

- Retail: ₹84,000 Cr revenue, PAT +28%

- O2C Segment: Strong refining margin, EBITDA +11%

- Capex: Focus on green energy & digital business

✅ Investor Takeaway:

- ₹2,000 ka target realistic mid-term (12 months) ke liye hai

- Stock fundamentals strong hain, especially retail & Jio segments

- Risk: Macroeconomic conditions ya global oil market volatility

📘 Keywords:

- Consolidated PAT: All business segments combined net profit

- EBITDA: Operating profit before tax, depreciation

- One-time Gain: Extraordinary profit from stake sale

- Resistance Level: Price level jahan stock ruk jaata hai

- 5G Subscribers: Jio’s growth indicator in telecom

⚠️ Disclaimer:

Yeh blog educational/informational purpose ke liye hai. Market mein nivesh risk ke adheen hota hai. Investment se pehle apne financial advisor se salah lein.

📍 For more updates visit: https://quickdaynews.com