RCF Share Price Target 2025: Can It Reach ₹190?

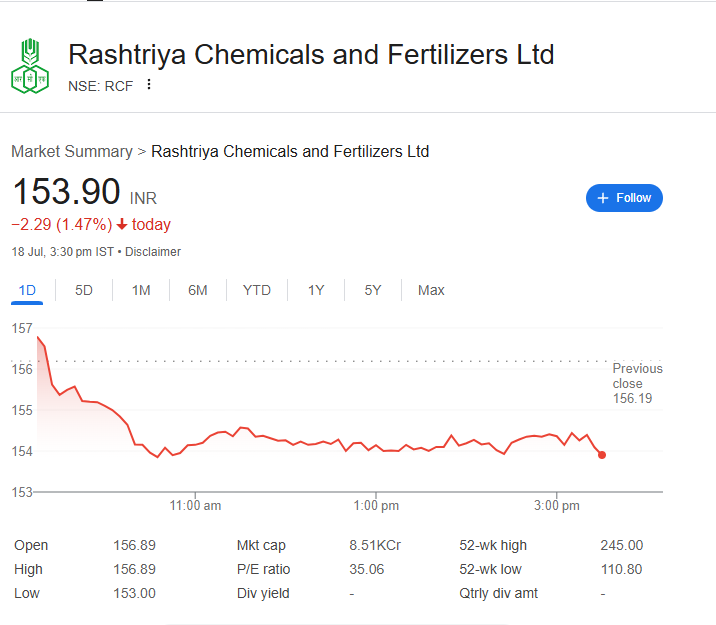

Rashtriya Chemicals & Fertilizers (RCF) is one of India’s key PSU players in the fertilizer and chemicals segment. As of now, RCF’s share is trading around ₹156. But the big question for investors is: Can it hit ₹190 by 2025?

📈 Year-Wise Share Price Targets

| Year | Target Price Range | Sentiment |

|---|---|---|

| 2024 End | ₹170 – ₹180 | Moderate Bullish |

| 2025 Mid | ₹180 – ₹185 | Bullish |

| 2025 End | ₹185 – ₹190+ | Bullish to Aggressive |

🧠 Buy Score: 7.8 / 10

- ✅ Strong demand from agriculture sector

- ✅ PSU support and dividend yield

- ⚠️ Resistance at ₹158–₹160

📉 Risk Score: 4.2 / 10

- Global commodity prices can affect margin

- Watch ₹151 as crucial support level

- Policy shifts can impact sentiment

🔍 Technical Analysis Sites (for Charting & Indicators)

- TradingView (RCF) – Live indicators and RSI/MACD summaries

- Investing.com – Live charting, technical sentiment

- TopStockResearch – Support, resistance, and trend details

- Moneycontrol – Pivots, RSI, MFI, volume

🎥 YouTube Technical Videos

🧭 Conclusion

RCF’s performance is supported by macroeconomic trends and sector strength. Technicals are signaling accumulation on dips. With ₹190 as a target, it’s a good fit for long-term PSU-focused investors.

Author: Kapeesh Chaubey

Published on: July 19, 2025

⚠️ Disclaimer

This content is for informational purposes only and not investment advice. Please consult your financial advisor before making stock purchases.

🔗 Visit for more updates: QuickDayNews.com

📌 Tags: #RCFSharePriceTarget #PSUStocks #RCF2025Target #StockMarketIndia #QuickDayNews