Published: August 12, 2025 • Author: Kapeesh

📌 Overview

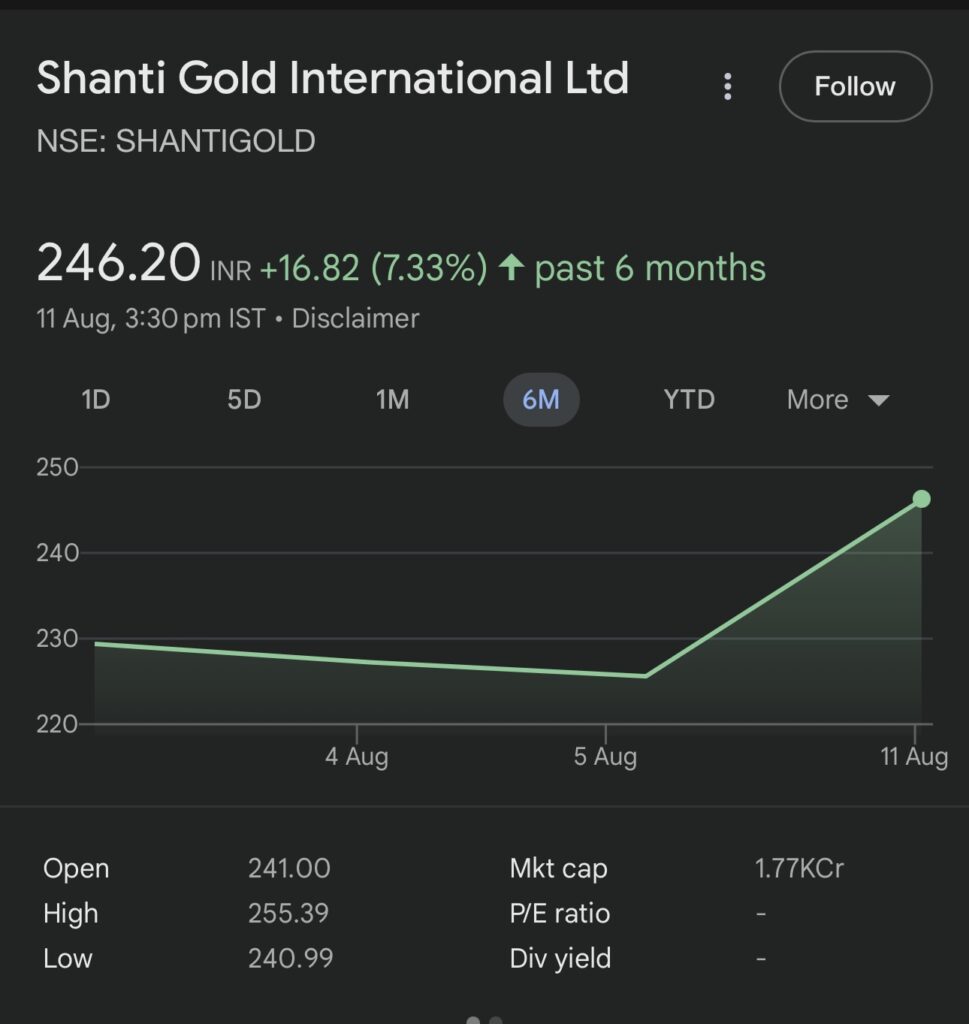

Shanti Gold International (NSE: SNTG) has attracted attention since its June 2025 listing. Trading momentum combined with strong YoY growth has traders asking whether the stock can reach ₹270–₹290 by December 2025.

Key Facts:

- Current Price (Aug 8, 2025): ₹239

- 52-Week Range: ₹217 – ₹252.50

- IPO Price: ₹199 — Listing Price: ₹227.55

💰 Fundamental Snapshot

- Revenue: ₹1,106 crore (up 56% YoY)

- Net Profit: ₹55.8 crore (up 108% YoY)

- Debt: Reasonable for expansion plans

- Sector tailwinds: Healthy gold demand ahead of festival & wedding seasons

Highlight: These growth rates position SNTG as a potential mid-cap momentum stock in jewellery.

📊 Technical Analysis

| Support Zone | Resistance Zone | Trend Bias |

|---|---|---|

| ₹217–₹220 | ₹238 / ₹252 | Bullish |

Price is forming higher lows since listing — a bullish sign. Traders are watching the ₹268–₹284 pivot range as a potential breakout zone.

🚀 Will It Hit ₹270–₹290 in 2025?

Current Setup: Trading between ₹230–₹247. Pivot resistance levels at ₹268.50 (R2) and ₹284.40 (R3) mean the ₹270–₹290 zone is reachable if a volume-backed breakout occurs.

Bullish Case

₹270–₹290 possible by Dec 2025 if earnings beat and gold prices stay supportive.

Base Case

₹250–₹270 with moderate buying pressure.

Bearish Case

₹200–₹210 if gold corrects or broader markets fall.

Risk Management

Consider stop-loss near ₹215 to protect downside.

Verdict: The ₹270–₹290 target is possible, not guaranteed. It depends on decisive technical breakouts, earnings momentum, and gold price trends.

📈 Catalysts & ⚠️ Risks

- Catalysts: Gold price stability/rise, festive demand, outperformance in Q3/Q4, strong volume breakouts

- Risks: Gold price correction, regulatory changes, market volatility

📝 Investment Takeaway

For traders: Look for a decisive close above ₹268 with strong volume for a run toward ₹270–₹290.

For long-term investors: Accumulate on dips near ₹220–₹225 with proper risk sizing.