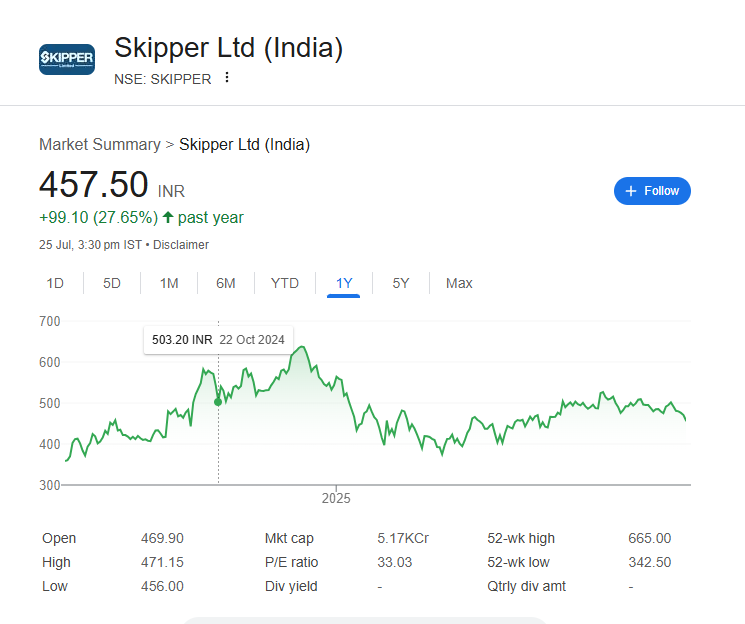

New Delhi, July 25, 2025 — Skipper Ltd, a leading infrastructure and power transmission company based in Kolkata, has been consolidating around the ₹475 level in recent weeks. Investors are now watching closely for signs of a potential breakout or sustained recovery through the remainder of 2025 for Skipper Share .

Current Share Price Trend :Skipper Share

As of mid-July 2025, Skipper Ltd’s stock is trading near ₹487.75. The stock recently tested a support level near ₹475, raising questions among investors about its near-term direction. Technical indicators currently reflect a mixed sentiment, with many showing “neutral” or “sell” signals on short-term timeframes.

Analyst Targets and Forecasts :Skipper Share

Several market analysts and forecasting platforms have shared their projections for Skipper’s share price through 2025:

- Trendlyne reports an average analyst target of ₹602.50, implying a potential upside of over 23 percent from current levels.

- Dailybulls forecasts a steady climb, with the stock expected to touch ₹628 by December 2025, assuming consistent financial performance and sector growth.

- WalletInvestor suggests a more bullish outlook, with targets as high as ₹661.50 within the next 12 months.

These targets reflect investor optimism about India’s infrastructure expansion, where companies like Skipper play a key role in transmission tower and pole manufacturing.

Recovery Possibilities in 2025 :Skipper Share

Here are possible scenarios based on public data and analyst insights:

| Scenario | Target Range (₹) | Notes |

|---|---|---|

| Conservative | 550 – 580 | Stable growth, no major policy changes |

| Moderate Optimism | 600 – 625 | Sector tailwinds and strong quarterly earnings |

| Bullish Scenario | 640 – 660 | Market rerating and major contract wins |

Key Drivers to Watch

- Government Infrastructure Push: Ongoing investments in power and rural electrification could create demand for Skipper’s core offerings.

- Export Growth: Skipper’s focus on international markets may provide a revenue cushion amid domestic competition.

- Raw Material Costs and Debt Levels: Any fluctuation in input costs or adverse financial ratios could limit the upside.

Conclusion

Skipper Ltd’s share price appears to be forming a base near ₹475. If the company maintains its project pipeline and meets earnings expectations, the stock could test the ₹600–₹650 range in 2025. However, investors should remain cautious of broader market volatility and competitive pressures.

Disclaimer

This article is for informational purposes only. It does not constitute investment advice or a stock recommendation. Investors are advised to conduct their own research or consult with a certified financial advisor before making any investment decisions.