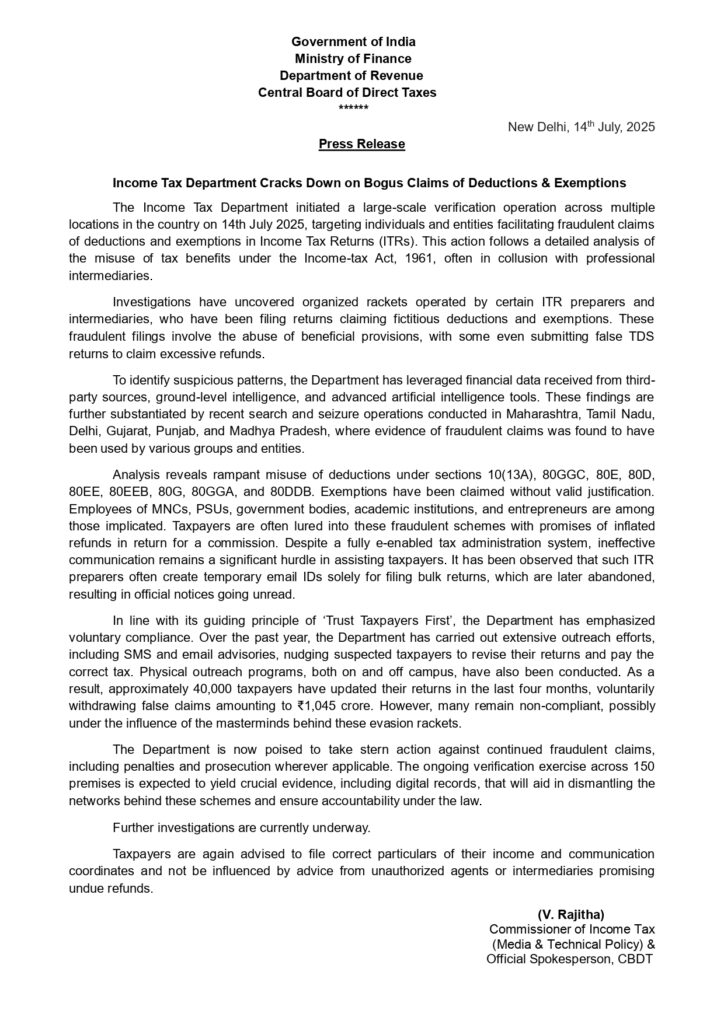

In a decisive move to curb tax fraud, the Income Tax Department of India has launched a comprehensive verification drive across the country. On 14th July 2025, the department began targeting individuals and organizations involved in fraudulent claims of deductions and exemptions in their Income Tax Returns (ITRs).

This crackdown comes after a detailed analysis revealed widespread misuse of tax provisions under the Income-tax Act, 1961, often facilitated by professional intermediaries.

What the Investigation Uncovered ?

Authorities have discovered organized rackets run by ITR preparers and agents who have been submitting false returns to claim excessive refunds. Some were found to be falsifying TDS returns and abusing legal provisions for personal gain.

To trace such frauds, the Department has employed advanced AI tools, financial data from third-party sources, and on-ground intelligence. Recent raids in states like Maharashtra, Tamil Nadu, Delhi, Gujarat, Punjab, and Madhya Pradesh have exposed widespread misuse by various entities.

🔍 Gambling Sector Under the Scanner

One of the most alarming findings is the misuse of ITR provisions by online gamblers and bettors. Reports reveal that many individuals associated with real money gaming (RMG), fantasy sports, online casinos, and betting platformswere:

- Claiming false losses as deductions

- Submitting bogus TDS certificates

- Using Section 80D, 80G, and 80DDB to launder gambling income and reduce tax liability

- Leveraging temporary email IDs to bulk-file fake returns for gamblers and online players in exchange for hefty commissions

These tactics were disguised as legal deductions, tricking unsuspecting gamblers into believing they were entitled to large refunds.

🚨 Key Deduction Sections Being Exploited

The department has found widespread misuse of the following Income Tax sections:

- Section 10(13A) – House Rent Allowance (misused even by those not paying rent)

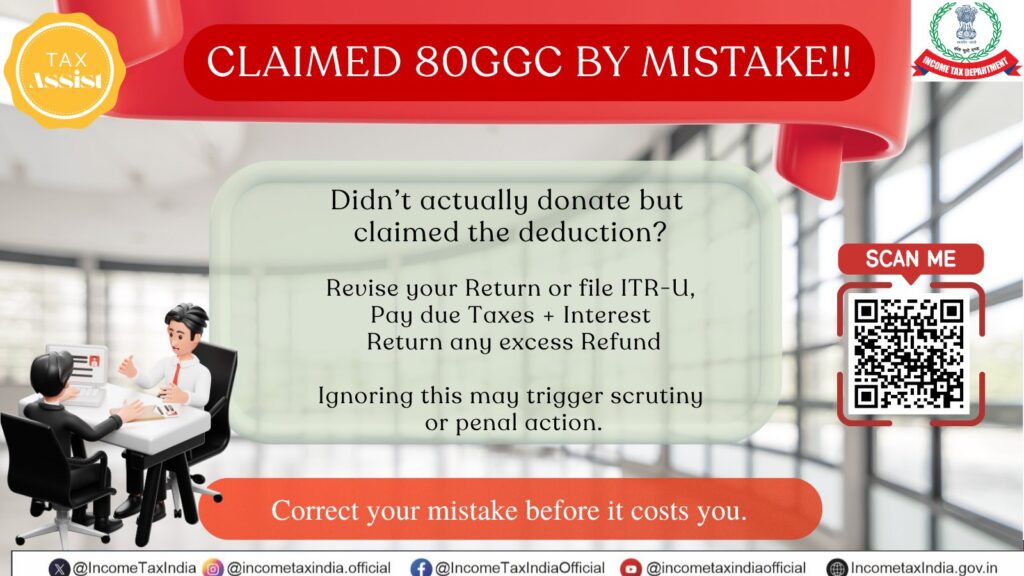

- Section 80GGC & 80G – Political & charitable donations with no proof

- Section 80E, 80D, 80EE, 80DDB – Education and medical claims used fictitiously

- Section 80GGA – Fraudulent claims related to scientific or rural development

➡️ Many of these were used to justify gambling-related incomes or convert them into tax-free “donations” or “expenses.”

💡 How the Scam Worked

Fraud agents targeting the gambling community would:

- Offer “zero tax refunds” to online players and gamblers

- File fake ITRs showing losses or deductions using temporary emails

- Disappear after the refund is processed

- Leave the taxpayer liable when notices are later issued

This scheme has reportedly affected thousands of individuals in fantasy gaming apps, poker platforms, and online betting circles.

🧾 ₹1,045 Crore Worth of False Refunds Withdrawn

Due to aggressive SMS, email, and campus-level outreach by the IT Department, nearly 40,000 taxpayers have voluntarily revised their returns and withdrew fraudulent claims amounting to ₹1,045 crore in the last four months.

However, many are still at risk—especially those influenced by unauthorized gambling agents promising “ITR ka paisa wapas”.

📢 Final Advisory for Gamers & Taxpayers

✅ Do not file ITR through unverified gaming agents

✅ Avoid using fake deductions like 80G or 80D to launder gambling earnings

✅ Always verify TDS details through the official income tax portal

✅ Be cautious of promises like “100% refund guaranteed” or “no tax on winnings”

🔒 What’s Next?

The Income Tax Department is preparing to:

- Prosecute intermediaries and ITR agents involved in this racket

- Use digital records and AI tools to trace the entire chain of transactions

- Conduct more raids across states like Maharashtra, Delhi, Punjab, Tamil Nadu, and Gujarat where gambling refund frauds were rampant

📌 Stay tuned to QuickDay News for verified updates on taxation, finance, and gaming regulations.

🔖 Tags: #IncomeTaxScam #GamblingFraud #ITRRefundScam #OnlineGamingTax #RMGIndia #FakeDeductions #CBDTAction #PokerTaxScam #FantasyRefundFraud #QuickDayNews